A tech-improved human role

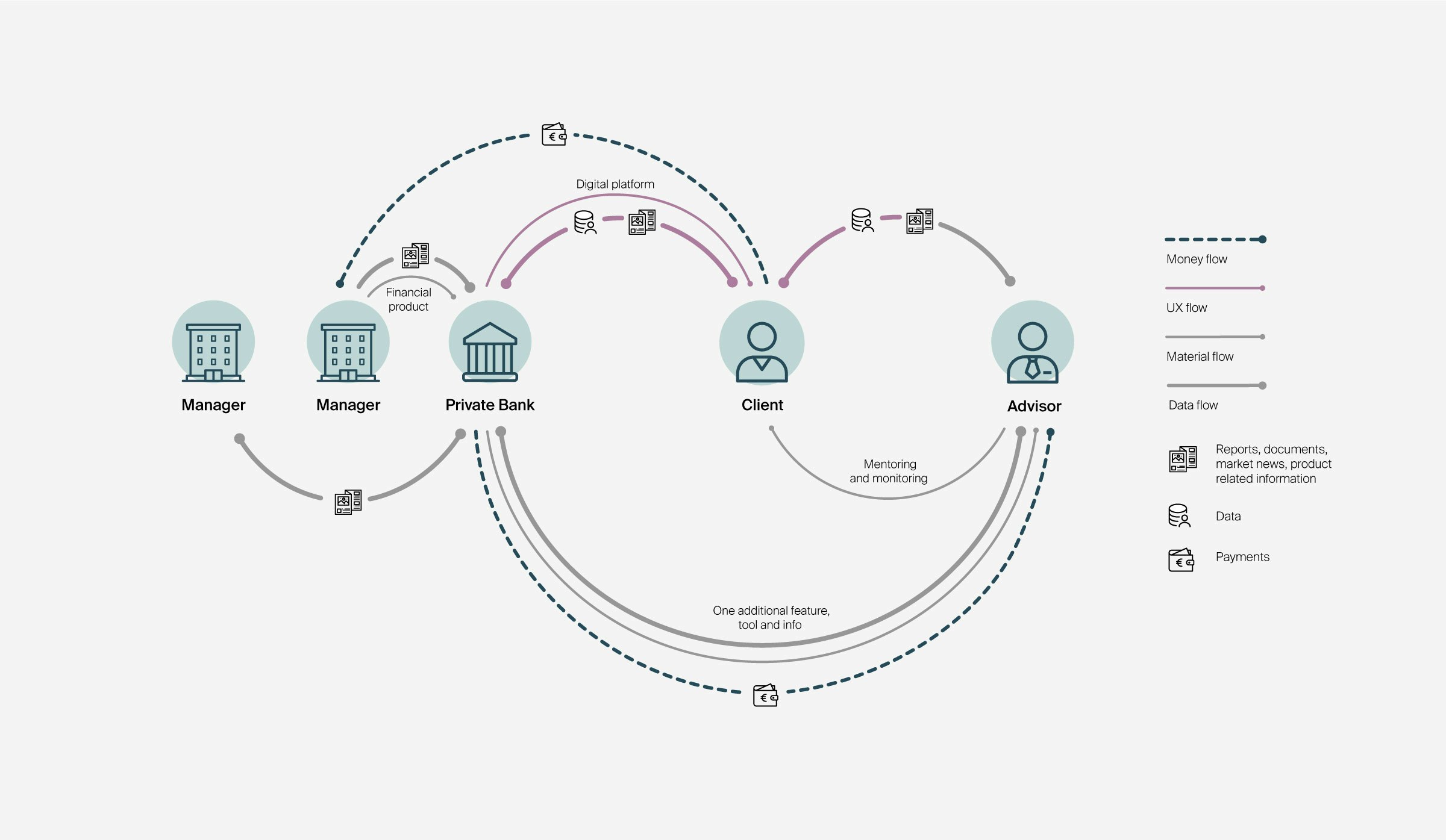

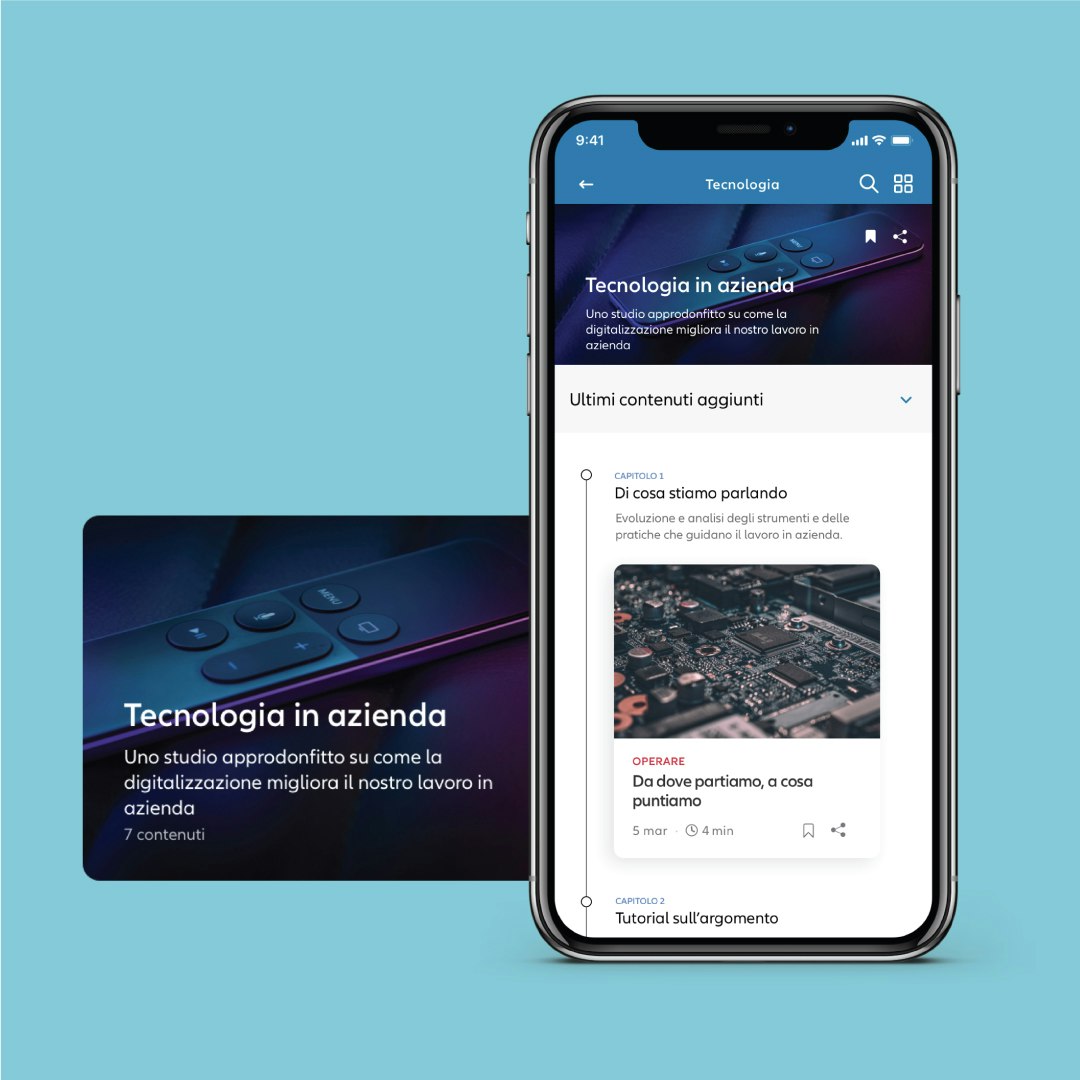

Our client is a global leader and employer in insurance and financial services with activities in more than 70 countries worldwide. The project originated from a need for redefining the role of the financial advisor and the bank’s organizational and information model.

We assessed the existing service model which is based on the strong relationship between the financial advisor and the final client, and between the client and the bank itself. By involving more than 1600 financial advisors, we investigated their end-to-end working experience and identified opportunities for empowerment.